Unexpected expenses can happen to anyone, and knowing how to access quick funds is crucial. The Check n Go Near Me Payday Loan options offer a simple way to get cash when you need it most, helping you make informed decisions and reduce stress.

What is a Payday Loan?

A payday loan is a short-term borrowing solution that helps cover urgent expenses until your next paycheck. With Check n Go, you can easily locate payday loan lenders & locations for quick access to funds.

How to Apply for a Payday Loan

Applying for a Check n Go Near Me Payday Loan is straightforward:

- Visit a Local Store: Find a nearby Check n Go location.

- Bring Required Documents: Have your ID, proof of income, and bank account details ready.

- Complete the Application: Fill out a quick application form for loan approval.

Benefits of Choosing Check n Go

- Fast Approval: Get cash quickly.

- Convenient Locations: Easily find a store near you.

- Flexible Terms: Choose a repayment plan that suits your needs.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

What Are the Requirements for a Payday Loan?

When you need quick cash, knowing the requirements for a Check n Go Near Me Payday Loan is essential. These loans help bridge the gap between paychecks, so understanding what you need to qualify can streamline your application process.

Basic Requirements for a Payday Loan

To apply for a payday loan, you generally need to meet these criteria:

- Age: At least 18 years old.

- Income: Proof of a steady income source.

- Identification: A valid ID, such as a driver’s license or passport.

- Bank Account: A checking account for deposits and repayments.

Importance of These Requirements

These requirements help payday loan lenders provide funds responsibly. Meeting them boosts your chances of approval, allowing you to access the money you need quickly. Searching for local options through “Check n Go Near Me Payday Loan” can lead you to the best lenders in your area.

How to Find Check n Go Locations Near You

Finding a Check n Go location near you is crucial for quick funds, especially for unexpected bills or urgent expenses. Knowing where to go can save you time and stress, allowing you to get the cash you need without a long wait.

How to Locate Check n Go Near You

To find a Check n Go near me payday loan location, try these simple methods:

- Online Search: Type “Check n Go near me” into a search engine to find the closest locations.

- Mobile Apps: Use the Check n Go app, which often has a store locator feature.

- Customer Service: Call their customer service for help in locating a store.

Benefits of Choosing Check n Go

Choosing Check n Go for your payday loan needs offers several advantages:

- Quick Access to Funds: Get cash quickly.

- Convenient Locations: Many payday loan lenders & locations make it easy to find one nearby.

- Friendly Staff: They assist you through the process, ensuring you get the funds you need.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Step-by-Step Guide to Applying for Quick Funds

When unexpected expenses arise, knowing how to access quick funds can be a lifesaver. The Check n Go Near Me Payday Loan provides a simple way to get cash without a long wait. Here’s a quick guide to help you apply for your payday loan efficiently.

1. Find Your Nearest Location

Begin by searching for “Check n Go near me payday loan” online to locate the closest branch. The Check n Go website is also a helpful resource for finding locations and hours.

2. Gather Required Documents

Before visiting, ensure you have the necessary documents, including:

- A valid ID

- Proof of income

- Bank account information

3. Visit the Store and Complete the Application

At the store, a staff member will assist you with the application. Fill out the form accurately to expedite approval, and you’ll receive a quick decision on your loan.

4. Receive Your Funds

If approved, you can get your funds on the same day, allowing you to address your financial needs promptly. This is a major advantage of payday loan lenders & locations like Check n Go.

Also Read: Payday Loan Lenders & Locations: Where to Apply Near You

What to Expect During the Application Process

When you find yourself in a financial pinch, knowing how to apply for a Check n Go Near Me Payday Loan can be a lifesaver. This quick funding option is designed to help you cover unexpected expenses, making the application process crucial for getting the help you need without delay.

Simple Steps to Follow

- Find a Location: Start by searching for Check n Go locations near you. This ensures you can apply in person or online, whichever you prefer.

- Gather Your Documents: You’ll need to provide some basic information, like your ID, proof of income, and bank details. Having these ready speeds up the process.

- Fill Out the Application: Whether online or in-store, the application is straightforward. Just answer a few questions about your financial situation.

Quick Approval

Once you submit your application, payday loan lenders typically review it quickly. You can expect to hear back in no time, often within minutes! If approved, you’ll receive your funds shortly after, helping you tackle those urgent expenses with ease.

Are Check n Go Payday Loans Right for You?

Unexpected expenses can be stressful, but Check n Go Near Me Payday Loans offer a quick solution to help you until your next paycheck. These loans are designed for fast access to cash, but are they the right choice for you? Let’s find out!

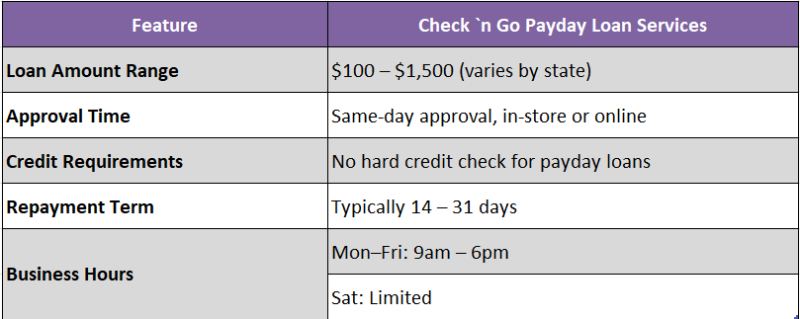

Understanding Check n Go Payday Loans

Check n Go is a well-known option among payday loan lenders & locations, providing an easy application process. Here’s what you need to know:

- Quick Approval: Most applications are approved within minutes.

- Flexible Amounts: Borrow between $100 and $1,000 based on your needs.

- Convenient Locations: Visit a Check n Go near you or apply online for assistance.

Is a Payday Loan Right for You?

Before applying, evaluate your financial situation by asking:

- Can you repay the loan on your next payday?

- Are there alternatives, like borrowing from friends or family?

- Do you understand the fees and interest rates?

If you can confidently repay, a Check n Go payday loan could be the quick fix you need!

Exploring the Benefits of Choosing Check n Go

Unexpected expenses can be stressful, but a Check n Go near me payday loan offers a quick solution. This option allows you to access cash fast, making it a popular choice for many individuals in need.

Quick Access to Funds

- Speedy Process: The application process is simple and often results in approval within minutes.

- Local Convenience: With nearby Check n Go locations, you can receive in-person assistance easily.

Flexible Loan Options

- Tailored Solutions: Check n Go provides various loan amounts to accommodate different financial situations.

- Transparent Terms: Expect clear terms with no hidden fees, simplifying your repayment planning.

In conclusion, a Check n Go near me payday loan is an efficient way to secure quick funds. With local payday loan lenders available, you can confidently address unexpected financial challenges.

Common Myths About Payday Loans Debunked

Payday loans, like the Check n Go Near Me Payday Loan, are popular quick cash solutions, but many myths can deter potential borrowers. Let’s debunk these misconceptions to help you make informed choices.

Myth 1: All Payday Loans Are the Same

Not all payday loan lenders & locations provide identical terms. Check n Go offers various options tailored to your needs, so it’s essential to compare lenders for the best fit.

Myth 2: You Need Perfect Credit to Qualify

A common belief is that only those with excellent credit can access payday loans. However, Check n Go Near Me Payday Loan services cater to individuals with different credit scores, focusing more on repayment ability than credit history.

Myth 3: Payday Loans Trap You in Debt

Some people think payday loans are designed to keep borrowers in debt. While responsible borrowing is vital, many lenders, including Check n Go, promote repayment plans that help you regain financial stability without falling into a debt cycle.

How AdvanceCash.com Can Help You Secure Your Funds

Unexpected expenses can be stressful, but knowing how to access quick funds can be a lifesaver. Check n Go Near Me Payday Loan provides a simple way to secure cash when you need it most, making it a go-to option for those in financial distress.

Easy Application Process

Applying for a payday loan with Check n Go is straightforward. You can start online or visit a local branch. Just gather your ID, proof of income, and bank details to get the funds you need without hassle.

Local Lenders at Your Fingertips

Check n Go helps you find payday loan lenders & locations nearby, so you won’t have to travel far for assistance. Simply search online for “check n go near me payday loan” to discover the closest options available.

Quick Approval Times

The approval process is typically fast, with many applicants receiving funds within a day. This quick turnaround is essential for urgent bills or unexpected costs, allowing you to breathe easier knowing help is just around the corner.

Tips for Managing Your Payday Loan Responsibly

When facing financial difficulties, a Check n Go Near Me Payday Loan can provide quick relief. However, managing these loans responsibly is crucial to avoid debt cycles. Knowing how to apply and utilize these funds wisely is essential.

Create a Budget

- Know Your Expenses: Track your monthly expenses to understand your spending habits.

- Plan for Repayment: Set aside enough money to repay your payday loan on time.

Avoid Taking Multiple Loans

- Stick to One Lender: Borrowing from multiple payday loan lenders can lead to excessive debt.

- Focus on Repayment: Pay off one loan before considering taking another.

Seek Help if Needed

- Talk to a Financial Advisor: Don’t hesitate to seek assistance if you’re struggling.

- Explore Alternatives: Consider options like credit unions or community assistance programs.

By following these guidelines, you can effectively manage your Check n Go Near Me Payday Loan and maintain your financial health. Responsible borrowing is vital for your financial well-being!

FAQs

➤ How can I find a Check ‘n Go payday loan location near me?

You can use the Check ‘n Go Store Locator by entering your city or ZIP code to find the nearest store and its hours.

➤ What documents do I need to apply for a payday loan at Check ‘n Go?

You’ll typically need a valid ID, proof of income, an active checking account, and contact information.

➤ Is a credit check required for a payday loan at Check ‘n Go?

Most payday loans from Check ‘n Go do not require a traditional credit check, making them accessible to borrowers with poor credit.

➤ Can I get a payday loan from Check ‘n Go online?

Yes, Check ‘n Go offers online payday loans in several states. You can apply directly through their website if eligible in your state.

➤ How quickly can I get funds from Check ‘n Go?

If approved in-store, you may receive funds the same day. Online loan approvals usually result in next-business-day deposits.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.